A Nevis Trust is one of the worlds leading offshore trust formation structures, along with the Cook Islands, is largely due to Nevis’s formidable asset protection legislation. As a result asset protection trust companies have become a major attraction for the tiny island with much of its offshore formation services largely revolving around Trust formation or the set up of a Nevis LLC which can have many similar aspects to an Asset Protection Trust.

The Nevis Trust is open to individuals and corporate entities from all backgrounds, with little restriction on the companies formation structure. Beneficiaries or settlers must however be non-residents and can not include local real estate. A Nevis Trust must be annually renewed and exists for a lifetime of 120 years.

What Makes a Nevis Trust Unique?

- In order to pursue any legal action against a Nevesian Trust a 100,000 USD bond must be placed with the Ministry of Finance

- Nevis law does not recognize forced heirship rules in the home country of a settlor or beneficiary

- It's possible to combine or split trusts

- Trustees do not have the power to make distributions of the trust other than what is intended in the Trust deed and as per the instructions of the beneficiary

- Nevisian trust law protects the assets of a trust from a creditor who tries to get at it through the trustee, or through the protector. A creditor can not force either parties to make distributions against the wishes of the settlor and as was directed by the trust.

- Intended beneficiaries can receive payments from the trust without taking on liability from a creditor

LLC held by a Trust

The most effective Trust Formation structure is when a Nevis LLC is held by a Trust. This makes the Trust the wonder of the LLC which you the client would be the beneficial owner/manager

An offshore bank account held by Trust

A Nevis Trust can hold not only a Nevis offshore bank accounts but an account from anywhere in the world.

Asset Protection Legislation of a Nevis Trust

Nevis Trust Legislation protects the settlor and beneficiary from fraudulent claims by imposing significant barriers from attempting to gain access. Only the most willful of creditors would be able to make a claim against it. If there is any legal claim against the Trust, a 100,000 USD bond must be played by the creditor before the claim is made, and will be risked in losing it if the Ministry feels it is a fishing attempt

A foreign creditor must prove fraudulent conveyance, in that a transfer was not only unlawful but was intentionally done to deceive that particular creditor. There must be evidence beyond a reasonable doubt that a fraudulent transfer was made to directly defraud the specific creditor. This is the only way that any type of legal action can work against a Nevis Trust.

There is a statute of limitations of 1 year of pursuance of any claims. Any claims made after will not be looked at by the Nevis courts. Creditors pursuing a claim must do so outside of the jurisdiction that they live in. Meaning, if a creditor is from the UK, they can not pursue a claim within the UK legal system, because Nevis is a sovereign nation and does not bow down to foreign court orders.

Nevisian asset protection law seeks to protect its offshore finance industry and clients. Consequently, creditors must pursue claims directly within the country and must go through the local court system, which will require time, money, effort and physical presence making only the most willful of creditors the strength to carry through, usually most creditors or grievances upon seeing the hurdles as they will risk losing the 100,000 bond, and in that case the often will drop the legal suit and settle out of court.

Difference between Onshore Trusts and Offshore Trusts

-

Onshore Trusts: Are established within the legal jurisdiction of the settlor's country of residence or where the assets are primarily located. They are subject to local laws and regulations, which can sometimes be more restrictive in terms of asset protection, tax benefits as well as privacy and confidentaility.

-

Offshore Trusts: Are set up in jurisdictions outside the settlor's country of residence, often in locations known for their favorable trust laws. These jurisdictions offer enhanced legal protections for assets, privacy for the settlor and beneficiaries, as well as zero taxes on the assets held. The significant distinction here is outside the settlor's country of residence, as this creates a shield of protection that prevents creditors from easily accessing the trust assets.

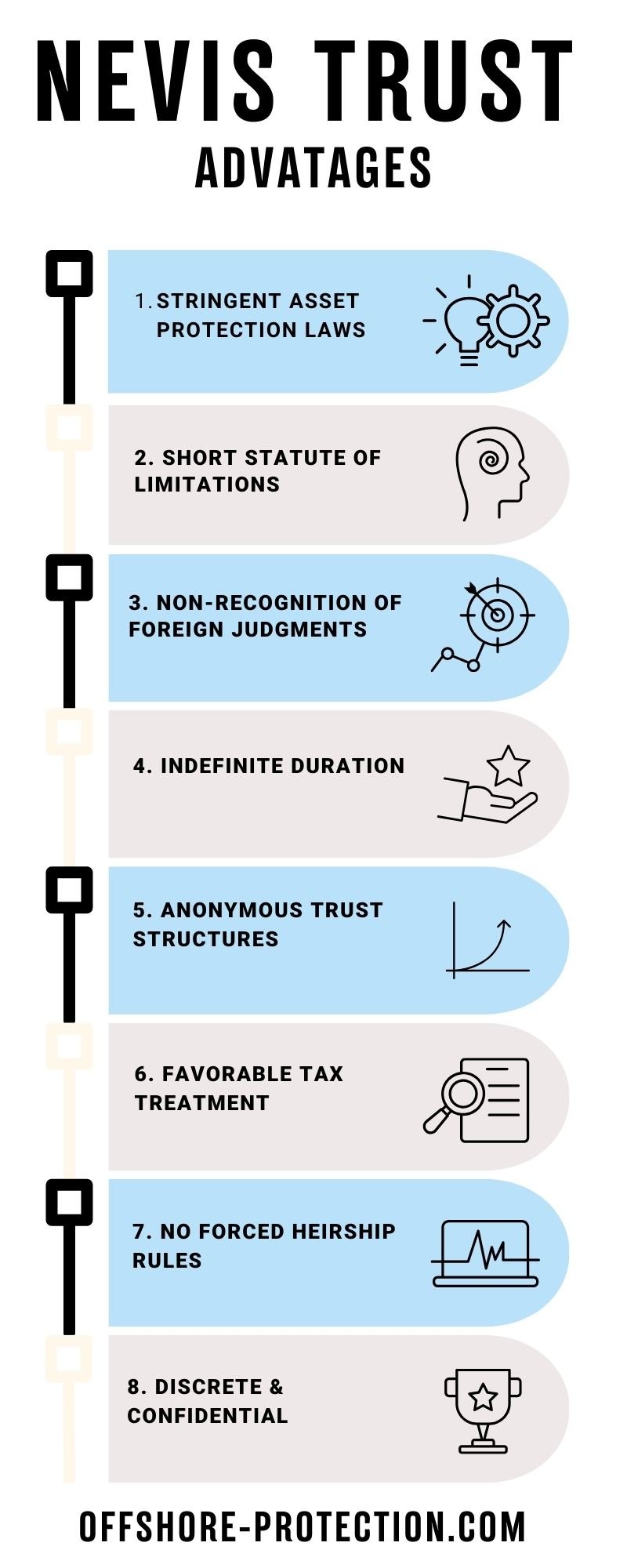

Advantages of a Nevis Trust

There are a number of advantages within a Nevis Trust, which include:

- Asset protection as investments are kept out of the reach of civil creditors in the case of divorce or bankruptcy

- Court orders in foreign countries do not have jurisdiction over an international trust nor can they have control over foreign citizens (your trustee or protector)

- Foreign governments have no authority over an international trust

- Clear separation of legal ownership of the title of the assets of the Trust from the beneficial ownership of the asset

- The Nevis Trust deed is not publicly registered

- Flexible structure that allows the trust to be changed, amended and settlor or protector re-appointed

- Sole Trustee ownership is available - a settlor can be the beneficiary

- Offshore Bank Accounts and LLCs can be opened under the name of the Trust

- Nevis has a good reputation and stable political and economic environment

- All information that are apart of a Nevis trust are held confidentially

- There is no taxation of a Nevis Trust and is free from custom and stamp

- No requirements to submit annual reports audits or financial statements

- Nevis does not have any international tax treaties with the USA

Top Uses

A Trust is an effective tool for

- Protecting family inheritance

- Mitigate unreasonable tax on assets intended for the beneficiary

- Protects individual in case of legal duress through the separation of assets

- Holding of assets can include

- Foreign physical property

- Intellectual property

- Bonds or stocks

- Virtually any other type of investment

Key Corporate Features

|

Trust Parties

Settlor

A Settlor is a person who establishes the trust by placing of assets into the trust vehicle. The settlor can also the manager who holds instructions concerning the assets for the beneficiary.

Trustee

A Trustee holds the legal title, however, they are not able to benefit from the trust. A Trustee acts as a safeguard over the assets in case of legal action against the Trust.

Protector

A trust protector has the power to direct a trustee in all matters relating to the Trust as well as the appointment or dismissal of any trustee persons.

Protectors are used mostly for non-charitable purposes and are highly recommended as it gives stability and a layer of internal protection in case there is disagreement amongst any parties of the trust. A protector is usually a family member or attorney.

Beneficiary

The beneficiary is included as any person that benefits from the Trust

What Our Clients SayTrusted by Thousands of Clients Since 1996."Offshore Protection helped me structure my assets in a way I never thought possible. Professional, discreet, and thorough — I wouldn't trust anyone else with my offshore strategy."— Private Investor, United States★★★★★

4.8 stars · 230 verified reviews

Different Types of Trusts

There are three main types of trusts that can be formed under this ordinance:

- Charitable trust

- Purpose trusts

- Spendthrift trusts

Trust Documents

A Trust Deed

A Trust Deed is a contractual agreement that has the details of the Trust and how the assets are to be managed and distributed.

Letter of Wishes

Contains the terms and details of the trust is in which the Settlor gives to the Trustee as per his/her wishes (which is amendable).

Registration includes

- Name Registration

- The registered address of the trust's office

- Name of trustee

Establishing a Nevis Trust

1. Select a Trustee

A trustee responsible for overseeing the trust's assets for the beneficiaries. This trustee could be a person, a trust company, or a corporate body.

2. Creating the Trust Agreement

Collaborate with your legal counsel to create the trust agreement, detailing the trust's purposes, conditions, and the duties and responsibilities of the settlor, trustee, and beneficiaries. This critical document dictates how the trust operates and the asset distribution mechanism.

3. Naming Beneficiaries

Identify the individuals or entities that will benefit from the trust. These beneficiaries can range from family members and friends to charitable organizations or other institutions, based on your preferences. It's important to note that neither beneficiaries nor the settlor can be residents of St Kitts & Nevis. A Protector can also be appointed, which is aoptional that can help monitor and manage the strust.

4. Asset Transfer

Convey the assets you want to include in the trust to the trustee. This could encompass property, financial assets, business interests, or other valuables that align with the trust's goals.

5. Trust Registration

The trustee is tasked with registering the trust with the Nevis Registrar of International Trusts. This step requires submitting details and covering the necessary fees. Information provided includes the trust's name, its registered address along with a declaration of compliance with the Nevis International Trust Ordinance. This registration process is designed to protect the client's privacy and anonymity. There's no need to register the trust deed or declaration, maintaining the confidentiality of the settlor and beneficiaries.

Taxation

There are no taxes that are imposed on a Nevis Trust:

- No gift tax

- No estate tax

- No excise tax

- No income tax

- No corporate tax

- No capital gains

How Can Offshore Protection Help You?

____

Offshore Protection is a boutique consultancy that specailizes in offshore solutions creating bespoke global strategies using offshore companies, trusts, and second citizenships so you can internationalize and diversify your business and assets.

We help you every step of the way, from start to finish with a global team of dedicated consultants. Contact us to see how we can help you.