In the world of offshore asset protection, the Cook Islands Trust is widely recognised as the gold standard. It was one of the first genuine offshore asset protection vehicles widely available to wealthy individuals from all parts of the globe.

To this day, it remains a highly effective tool to protect one’s wealth, maximise financial privacy and safety, and optimise estate planning and taxes.

In this article, we will focus on specific aspects related to the Cook Islands trust, such as whether it is legal and safe, what problems there may be if any, why people form Cook Islands trusts, and the important roles of different parties like the trustee and trust attorney.

Are Cook Islands Asset Protection Trusts Legal?

Cook Islands Trusts are completely legal financial vehicles for asset protection. Trusts formed in the Cook Islands comply with international laws and standards for transparency and anti-money laundering, and there is nothing which makes their use illegal.

In fact, many legal professionals agree that a Cook Islands Trust is the strongest legal asset protection vehicle in the world today.

The media and public opinion often portray offshore trusts as just being a way for criminals to commit fraud, but this is certainly not the norm, especially when it comes to a reputable trust structure like in the Cook Islands.

Cook Islands has numerous regulations and governing bodies in force which apply to its asset protection trusts and ensure that they remain legal and compliant. These include:

- Anti-Money Laundering (AML) regulations,

- Combating Financial Terrorism (CFT) systems,

- The Financial Supervisory Commission (FSC),

- The Financial Transaction Reporting Act (FTRA),

- Cook Islands Financial Intelligence Unit (CIFIU).

Is a Cook Islands Trust Safe?

Cook Islands’ government entities and its unique trust regulations work together to ensure that a Cook Islands trust is one of the safest financial vehicles available in the world. Thus, Cook Islands trusts have the major advantage of providing the utmost protection to your assets in a way that is completely legal and compliant.

In general, asset protection trusts are extremely safe and effective financial vehicles by nature. This is because they remove legal ownership of the assets from the grantor and transfer them to a separate legal entity (the trust).

At the same time, the grantor is allowed to simultaneously name themselves the sole beneficiary, meaning they retain the benefits of the assets, and for all practical purposes remain in control of the assets they have transferred to the trust.

In addition, they are irrevocable, which means that the terms cannot be changed, and the assets cannot be simply withdrawn by the grantor if the court orders them to do so. This is in stark contrast to revocable trusts whereby the grantor legally retains ownership of the assets.

Characteristics of a Cook Islands trust

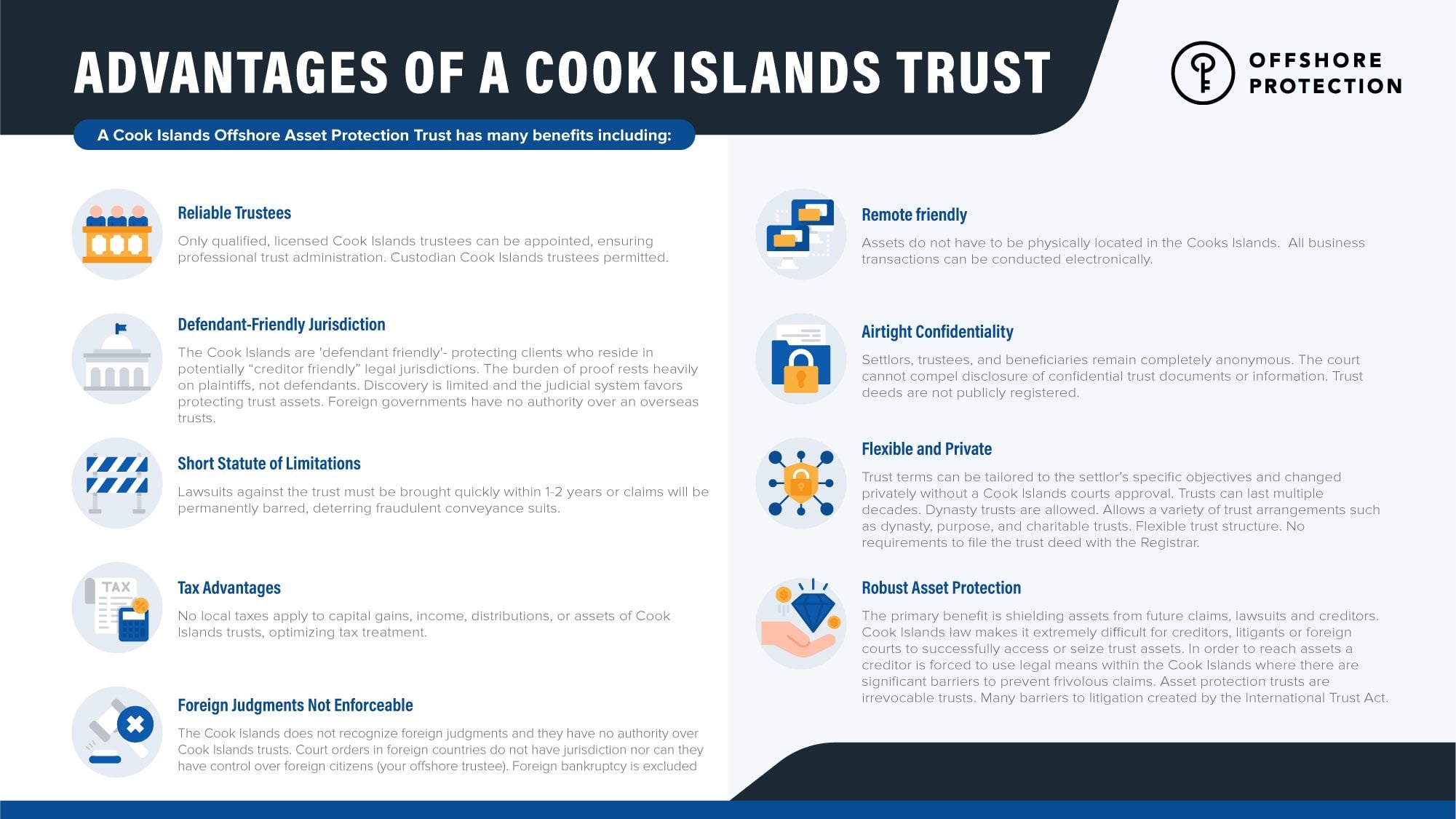

In addition to this, there are a number of specific characteristics of a Cook Islands trust which make it especially safe and effective, even when compared to other conventional asset protection trusts. These include:

1. Short statute of limitations of only two years

“Statute of limitations” is the maximum time period that a creditor has in which to make a legal claim on assets, from the day of the “cause of action”. This means that when the statute of limitations has passed, the plaintiff is generally not allowed to open a lawsuit anymore.

The statute of limitations in the Cook Islands is a mere two years. This means that if more than two years has passed since the event occurred that allows a person to make a claim on the assets, they can no longer do so.

If this time period has passed, they will also not be able to make a case of fraudulent conveyance, which is defined as deliberately transferring assets so as to put them beyond a creditor’s reach.

2. High level of protection from foreign court rulings

Even if a creditor does manage to bring a case against you within the short state of limitations period, they will have a tough time successfully claiming any of the assets held in the safety of the trust.

The Cook Islands’ judiciary system does not take kindly or even recognise foreign court rulings. This is especially the case when it comes to financial matters and claims, such as those related to trusts based in the Cook Islands.

As such, the plaintiff must open a new case in the Cook Islands itself, even if they have already initiated a case in another jurisdiction.

First off, this itself is an added barrier with additional expenses and complexities which deters most prospective plaintiffs. Secondly, trust law in the Cook Islands is extremely protective towards trusts on its shores, and it is rare and difficult to successfully claim assets held by such a trust. This is confirmed in the strong case law which has upheld the rights and protections of asset protection trusts.

3. Confidentiality

A creditor needs to know about the assets you hold in order to make a claim against them.

If you keep your assets in a domestic asset protection trust, it will indeed provide some level of protection, but a quick search by any attorney will be able to identify these assets and link them to your name.

On the other hand, Cook Islands upholds the sanctity of financial privacy, especially for its trust holders. This will offer you a high level of confidentiality which will make it difficult for creditors to find your assets and thereafter make a claim against them.

Read more: Setting up a Cook Islands Trust

Are There Any Problems with Cook Islands Asset Protection Trusts?

It should be clear that Cook Islands trusts are extremely powerful financial vehicles for asset protection, and therefore there are not many problems associated with using them. We have put together a few potential issues to be aware of though:

- Cost: forming and then maintaining a Cook Islands trust is by no means cheap. There are various things which contribute to the high costs, such as: trustee expenses, bank account fees, brokerage fees, complying with IRS reporting requirements, annual maintenance fees. The total formation costs can easily end up being between $10,000, along with ongoing annual fees of $5,000. This really only makes Cook Islands trusts suitable for very high-net-worth individuals who intend to transfer large sums of capital or assets to the trust.

- Unwillingness to give up control of assets: the prospect of relinquishing control of their assets to a trustee is daunting for many settlors, and they feel reluctant to do so. This obviously creates a problem, because it means the trust cannot be properly set up and the assets will remain unprotected.

- This reluctance comes from a misunderstanding of the level of protection provided by the trust structure and not knowing how to find a reputable trustee. There are trustee companies which provide insurance cover to their clients in the case of negligence or loss arising due to their trustee services. Furthermore, a trustee is legally not able to benefit from the trust. They can only step in and act in the best interest of the trust if the assets are under threat due to a court case for example. They must behave in accordance with Cook Islands trust laws and your instructions as the grantor, and so can never run off with the assets in the trust.

- Failure to properly report assets to the IRS and complete federal disclosures: The US has stringent reporting and disclosure requirements that it applies to its taxpayers, which includes all US citizens and residents worldwide. If the grantor and/or beneficiary of a Cook Island’s trust is a US citizen or resident, they must report all assets held by the trust to the IRS for tax purposes. Failure to do so could result in federal tax compliance issues where there could be penalties or even criminal charges. Not even the highly protective Cook Islands trust is completely out of reach of the IRS, so do not make the mistake of thinking your assets held abroad are exempt from these compliance requirements.

Why Do People Have Them?

The primary reason for forming a Cook Islands trust is to protect your assets from lawsuits and other dangers. We already discussed the powerful protective mechanisms offered by Cook Islands trusts, which makes them highly suitable as asset protection vehicles.

In addition, there are other benefits and uses of Cook Islands trust, such as to optimise estate planning, legally reduce taxes, open new investment opportunities, and maintain financial privacy.

To summarise, some of the most popular uses of a Cook Islands trust include:

- Protecting assets from a divorce,

- General asset and investment protection (inc. bank accounts, equities, bonds, etc.),

- Protecting real estate and other tangible assets,

- As a way to protect assets after a lawsuit,

- Protecting assets before marriage (this is more effective than protecting assets after a divorce, as assets placed in the trust before marriage are extremely difficult for the spouse to claim),

- Estate planning,

- Protection of business sale proceeds,

- Tax optimisation,

- Access to new investment opportunities through the trust.

How does A Cook Islands Trust work in a Divorce?

A Cook Islands asset protection trust is one of the most powerful vehicles available to protect assets. As much as we like to believe otherwise, the harsh reality is that divorces are very common, and oftentimes end in bitterness. If you are a high-net-worth individual, such a situation places your assets directly at risk to claims made by a disgruntled spouse.

Cook Islands trusts place the assets far out of reach of local matrimonial court rulings, and make them extremely difficult for your ex-spouse to lay their hands on. In order to avoid a case of fraudulent conveyance, it is important to transfer the assets into the trust early in the marriage, long before there is any cause for divorce.

In addition, the Cook Islands has unique legislation regarding the treatment of assets held in a joint trust during divorce. This falls under the International Relationship Property Trust Act.

Under this act, married couples who have formed a Cook Islands trust together for the sake of their heirs or other beneficiaries, cannot simply liquidate these assets upon divorce and share the proceeds, as they would do in the US.

4.8 stars · 230 verified reviews

The act protects the assets in the trust and allows it to remain intact for its intended purpose. This has the following benefits:

- Reduces litigation pertaining to assets during the divorce process,

- Restricts the power of the court to divide and distribute trust assets during a divorce,

- Protects the interests of beneficiaries and future generations,

- Prevents reckless liquidation of assets which would erode their value and lead to a loss of capital,

- Provides special protection for assets of a family business.

So, whether you want to protect your personal assets from a greedy and bitter ex-spouse, or you want to put assets away together with your partner for future generations, you can rest assure that the assets will be protected for their intended purpose with a Cook Islands trust.

Read more: about the most effective use of a Nevis LLC + Cook Islands Trust

How to Navigate the Legal Framework for International Trusts?

How does one distinguish between various international trust structures? Identifying the differences hinges on examining jurisdictional legislation. Each country enforces unique laws governing trusts. The Cook Islands, for example, boasts robust asset protection laws, unlike its more lenient counterparts. This disparity necessitates a thorough comparative analysis for effective trust establishment.

Why should people consider the Cook Islands Trust specifically? The answer lies in its unparalleled legal protections against creditors. The Cook Islands create a fortress around assets, deterring potential legal challenges. Conversely, trusts in other jurisdictions may offer weaker defenses, leaving assets vulnerable. This stark contrast underscores the Cook Islands' appeal to those seeking maximum security for their wealth.

The Cook Islands Trust offers more substantial asset protection than its counterparts, like the Nevada Trust in the United States or the Jersey Trust in the Channel Islands. Where Nevada may offer faster setup times, the Cook Islands prioritizes security. While Jersey provides tax advantages, the Cook Islands excels in safeguarding against legal judgments. This balance of attributes positions the Cook Islands Trust as a premier choice for those prioritizing asset protection in the complex world of international trusts.

What Are the Estate Planning Benefits with a Cook Islands Trust?

How do these trusts simplify succession? Cook Islands Trusts bypass probate. Probate processes often delay asset distribution and inflate legal costs, disadvantaging heirs. In contrast, these trusts transfer wealth swiftly and efficiently, directly benefiting beneficiaries without unnecessary legal entanglements.

What makes these trusts stand out in terms of confidentiality? The Cook Islands offer unparalleled privacy. Other jurisdictions, like the United States or European countries, enforce laws that compromise privacy, demanding disclosure of trust details. The Cook Islands, however, safeguard information, protecting trust settlors and beneficiaries from undue public scrutiny.

Comparing Cook Islands Trusts to standard domestic trusts, one notices stark differences. Domestic trusts frequently fall prey to local court decisions; Cook Islands Trusts do not. Local courts can freeze assets within their jurisdiction; assets in the Cook Islands remain untouchable. Domestic trusts often require public disclosure of assets; Cook Islands Trusts maintain secrecy, keeping assets invisible to prying eyes. These comparisons highlight the substantial advantages a Cook Islands Trust offers for estate planning, emphasizing its superiority in protecting and preserving wealth.

Common Questions

Do You Need a good Attorney?

It is essential to find a good asset protection attorney who is familiar with the structure of an offshore trust in the Cook Islands to help you set up the trust in the most effective way possible.

Trust law is complex, and there is a great deal of paperwork required and a subtle understanding of the law to ensure that everything is set up properly and your assets are adequately protected.

A Cook Islands Trust attorney can provide you with the necessary expertise to guide you through this process. There are reputable companies offering such services in the Cook Islands and abroad, but they do come at a hefty fee.

Do You Need a local Trustee?

One of the requirements of establishing a Cook Islands trust is to designate a trustee who is based in the Cook Islands. The best way to do this is to use the trustee services offered by a well-known Cook Islands Trust Company (see below). This will include full insurance against any losses to your assets caused by the negligence of the trustee.

The trustee will act for the sole benefit of the trust and its beneficiaries, and follow your instructions unless they need to step and protect the assets in the trust due to a court ruling against you as the settlor to hand over its assets.

This is the only time in which they can go against your instructions and refuse to hand over the assets held by the trust to the courts.

What is Cook Islands Trust Company?

A trust company is an entity that is able to serve as a trustee or agent of a trust as opposed to nominating an individual trustee.

Trust companies offer many additional benefits compared to an ordinary trustee, as their services extend well beyond just operating as the trustee. In addition, they can:

- Handle estate settlements and oversee the process of distributing the trust’s assets to beneficiaries,

- Perform orthodox financial wealth management services,

- Handle equity transfers and beneficial ownership registration,

- Perform other financial services offered by commercial banks and other financial service providers.

Reviews of a Cook Islands Trust?

Case studies and personal experiences and reviews of Cook Islands trusts show that they have historically been highly successful at protecting people’s assets from lawsuits and other dangers.

There is a wealth of resources available online which speak of the high efficacy of Cook Islands trusts for asset protection purposes. The Cook Islands trust was the first real offshore asset protection vehicle available and is still widely considered the very best.

A Cook Islands Trust has never been broken into by the US government. Although trusts held in the US have been broken into by US courts. Federal Courts have so far not been able to litigate against a trust as it would have to do so in a Cook Islands court room.

The Cook Islands generally are not the location people search out for when tried to evade taxes.

Common Problems When Setting Up a Cook Islands Trust

1. High Costs and Complexity

Setup Fees: Establishing a Cook Islands Trust typically costs 25,000–50,000+ in legal and trustee fees & ongoing annual trustee fees (often 5,000–15,000), while legal compliance and administrative expenses add up over time.

Complexity: Requires coordination between U.S. attorneys, Cook Islands trustees, and tax advisors.

Solution: Work with experienced offshore trust attorneys to streamline the process and avoid costly mistakes.

2. Timing Issues (Fraudulent Transfer Risks)

Proactive Planning Required: If the trust is created after a lawsuit, debt, or foreseeable liability arises, courts may deem it a fraudulent conveyance and invalidate the transfers.

Cook Islands Law: While Cook Islands courts require creditors to prove fraud “beyond a reasonable doubt,” U.S. courts may still penalize you for contempt or sanctions.

Solution: Set up the trust years before litigation risks materialize to ensure compliance with statutes of limitations (2 years in Cook Islands).

3. Loss of Control Over Assets

Irrevocable Structure: The grantor cannot revoke the trust or unilaterally reclaim assets.

Independent Trustee Required: A Cook Islands-licensed trustee must manage the trust, limiting direct control.

Solution: Use a trust protector (a trusted third party) to retain limited powers (e.g., changing trustees, modifying administrative terms).

4. Tax Compliance and Reporting Obligations

U.S. Tax Filings: Cook Islands Trusts are considered foreign trusts by the IRS, requiring complex filings: Form 3520/3520-A (annual reporting of foreign trust transactions) and FBAR/Form 8938 (reporting foreign financial accounts).

Penalties: Non-compliance can trigger fines up to $10,000+ per violation or criminal charges.

Solution: Partner with a U.S. CPA or tax attorney specializing in offshore trusts to ensure compliance.

5. Trustee Reliability and Communication

Geographic Barriers: Trustees are based in the Cook Islands, which can lead to delays in communication or decision-making.

Trustee Misconduct: Rare but possible—e.g., mismanagement of assets or failure to follow instructions.

Solution: Choose a reputable, licensed trustee with a proven track record and include clear terms in the trust deed for asset management and dispute resolution.

6. Jurisdictional Risks

Enforcement Challenges: While Cook Islands courts are creditor-hostile, U.S. courts may pressure you to repatriate assets (e.g., via contempt orders).

Political/Regulatory Changes: Shifts in Cook Islands law or international tax treaties could weaken protections.

Solution: Diversify assets across multiple jurisdictions (e.g., Cook Islands + Nevis) to mitigate risk.

7. Funding the Trust Correctly

Improper Asset Transfers: Failing to formally retitle assets (real estate, accounts, etc.) into the trust’s name leaves them unprotected.

Retaining Beneficial Use: If the grantor continues using trust assets (e.g., living in a home owned by the trust), courts may pierce the trust.

Solution: Transfer assets completely and irrevocably into the trust, with no retained control or benefit.

8. Ethical and Reputational Risks

Perception of Secrecy: Offshore trusts are often stigmatized as “tax evasion” or “hidden wealth” vehicles, even if legally compliant.

Public Scrutiny: Trusts may be exposed in lawsuits, divorces, or leaks (e.g., the Pandora Papers).

Solution: Maintain transparency with tax authorities and use the trust solely for legitimate asset protection, not tax evasion.

9. Limited Access to Assets

Distribution Restrictions: The trust deed may limit how and when beneficiaries can access funds.

Liquidity Challenges: Selling trust-owned assets (e.g., real estate) requires trustee approval, which can be slow.

Solution: Build flexibility into the trust deed (e.g., allowing loans to beneficiaries or discretionary distributions).

10. Misunderstanding the Trust’s Purpose

Not a Tax Haven: Cook Islands Trusts offer asset protection, not tax avoidance. Income is still taxable in the grantor’s home country.

Not Bulletproof: While robust, the trust can still be challenged if improperly structured or funded.

Solution: Align expectations with reality—use the trust as part of a broader wealth protection plan.

Is a Trust For You?

Get in touch with a consultation and find out.

How Can Offshore Protection Help You?

____

Offshore Protection is a boutique consultancy that specailizes in offshore solutions creating bespoke global strategies using offshore companies, trusts, and second citizenships so you can internationalize and diversify your business and assets.

We help you every step of the way, from start to finish with a global team of dedicated consultants. Contact us to see how we can help you.