Corporate structure defines how a business is organized, outlining roles, responsibilities, decision-making processes, and legal frameworks. It shapes how a company operates, allocates resources, and complies with laws. Below is an in-depth breakdown, including types, key components, and real-world examples.

What Is Corporate Structure?

Corporate structure refers to the fundamental organisation of different departments and business units within a corporate entity. The basic corporate structure of different companies varies greatly depending upon their approach, objectives, and nature of business. Corporate structure can also vary across different offices, units, or departments within the same company.

Quick Breakdown

A corporate structure refers to the legal and operational framework that determines:

-

Ownership: Who owns the company (e.g., shareholders, members).

-

Management: How decisions are made (e.g., board of directors, executives).

-

Liability: The extent to which owners are personally responsible for debts.

-

Taxation: How the business is taxed (e.g., pass-through vs. double taxation).

Why Is It Important?

The way in which a company organises and structures itself has a major impact on its operational efficiency and therefore its overall success. The corporate structure acts like a foundation on which everything else is built. It is therefore of utmost importance for there to be a clear and well-organised corporate structure to ensure smooth overall functioning.

Corporate structure involves clearly defining roles and protocols for managing business operations. It therefore helps to enable key employees to understand their responsibilities and powers, and allows for integrated functioning across different departments and units. A good corporate structure can aid in properly delegating responsibilities and therefore reduces wasted time and resources. It can also help to avoid unnecessary conflicts.

What Are the Four Main Types?

Although the specific corporate structure of each company can be quite unique, there are four main types of organisational structures that most companies use:

1. Functional Structure

The most common form of organisational structure for corporations is a functional structure. In this type of structure, employees are categorised and grouped into different functional departments according to the nature of the work they perform, their skillsets, and responsibilities. This creates distinct departments which work together to perform their duties (e.g., Human Resources department, Accounting, IT, Marketing, etc.).

This type of structure allows for a high degree of efficiency within each department and fast decision-making processes. It is also relatively simple, making it easy to manage and to generate departmental financial and operational reports. One drawback is that there can be a lack of efficient inter-departmental communication and teamwork, and certain responsibilities that overlap between two departments might be neglected.

2. Divisional Structure

A divisional structure is a way to organise operations into the specific market segments, products/services, or customer groups that each relates to. This allows the company to meet the requirements of specific groups or areas more effectively, and to tailor their operations in each of these areas. A good example of a divisional structure is a company which has divided its units geographically, where regional offices work together to effectively provide products/services in their area. Another example is a company with different distinct product lines which organises different business units for each type of product or service it provides.

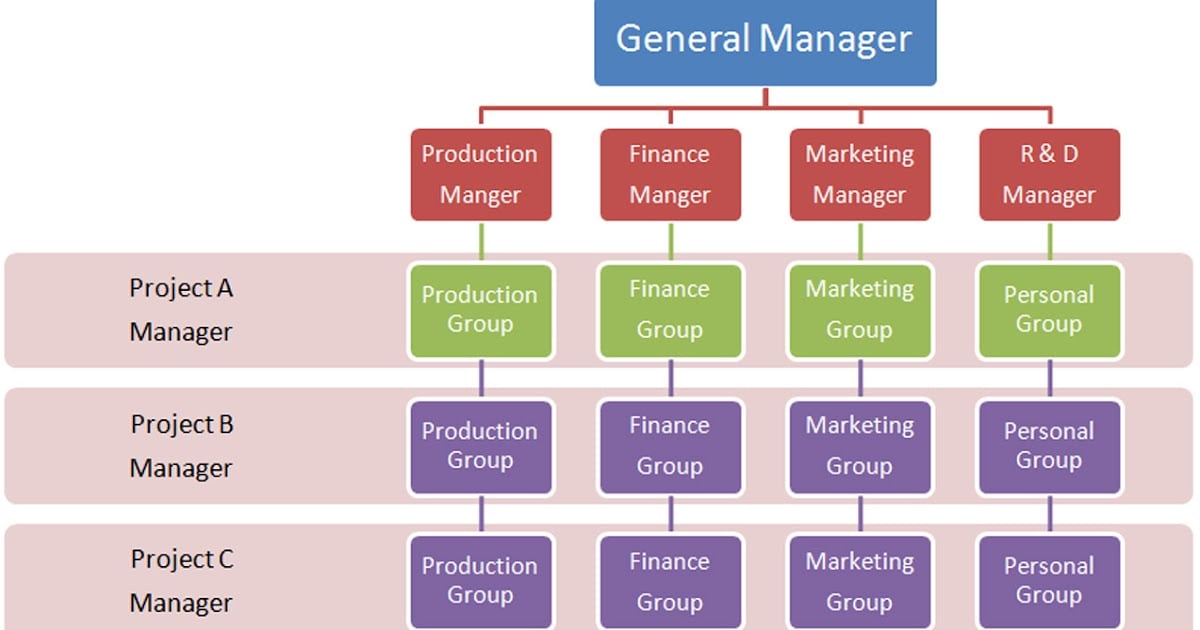

3. Matrix Structure

A matrix structure combines functional and divisional structures. For example, the company could be divided into various regional or product divisions, each with their own set of functional departments. Each division could have their own managers for the various departments, or there could be overall company managers for each department who in turn deal with all of the divisions, or both.

Here is a good graphical illustration of a matrix structure:

The advantages of matrix structures are that they allow for decentralised management, increased autonomy, and better inter-departmental communication. However, this type of structure is more complex, results in higher costs, and may also lead to increased managerial conflicts.

4. Hybrid Structure

Hybrid corporate structures are similar to matrix structures in that they combine the features of functional and divisional structures. However, the difference is that the various departments of the company are organised as either functional or divisional, as opposed to the grid organisation of the matrix structure.

This allows for a greater level of organisational freedom, in that the company is not bound by one type of organisational structure. It enables them to organise departments and divisions according to each one’s needs and preferences. Hybrid structures are mostly found in larger organisations.

What Our Clients SayTrusted by Thousands of Clients

Since 1996."Offshore Protection helped me structure my assets in a way I never thought possible. Professional, discreet, and thorough — I wouldn't trust anyone else with my offshore strategy."— Private Investor, United States★★★★★

4.8 stars · 230 verified reviews

Understanding for Financial Planning and Analysis

An important consideration when choosing and creating the right corporate structure, is how it relates to the financial planning and analysis of the company. This is a critical part of corporate planning, and each type of structure will have its own level of complexity and implications on the ability to perform such analyses.

Due to the wide variations in corporate structure across different companies, it is important for the company’s financial analysts to clearly understand how the corporation is structured and divided. They must work in close conjunction with the different business units so as to understand how they fit in and therefore provide accurate reporting.

Comparing Different Structures

Functional and divisional corporate structures are generally the simplest and therefore the easiest to monitor and analyse from a financial planning perspective. They are also the cheapest and easiest to design and maintain. However, they lack the level of adaptability of matrix and hybrid structures.

Matrix structures, on the other hand, can be far more complex and difficult to track. Employees often have multiple reporting relationships requiring them to report to one or more functional managers and divisional/product managers. This can of course lead to confusion from a financial analysis perspective, as it is not always clear whether a resource was utilised by one of the divisions or functions. Having multiple intersecting teams can indeed create issues, both from an operational and a financial planning viewpoint. However, it does also have its advantages, as it can lead to greater innovation and integration across different business units if done effectively.

Many larger corporations are now choosing a hybrid corporate structure, as it removes the complexity of matrix structures. It also provides the desired level of adaptability and innovation compared to the more rigid simplicity of divisional and functional structures.

How Are They Managed?

Now that we have discussed the main types of overall corporate structures which are commonly utilised, it is important to briefly mention the top-level management hierarchy. The corporate hierarchy is responsible for the management and oversight of the organisation as a whole, and is important to ensure that the individual units all function together harmoniously and work together to achieve the overall corporate vision.

The most common structure of management for corporations is a two-tier corporate hierarchy:

The first tier is comprised of a board of directors who are elected by the shareholders. The board in turn elects a chairman who is responsible for running the board. The board can be made up of “inside directors”, meaning they also form part of the management team (e.g., the CEO, COO, or CFO could be a part of the board of directors). Alternatively, it can also include “outside directors”, which are those who are not involved with the organisational management of the company itself.

The second tier is comprised of the upper management of the company, who are hired by the board of directors. The members of the upper management team are directly responsible for managing the actual day-to-day operational activities of the company and aim to ensure it is profitable. The principal members of the upper management team include:

- Chief Executive Officer (CEO): The CEO is the top manager, and is responsible for the corporation’s overall operations and smooth functioning. The CEO reports directly to the chairman and board of directors.

- Chief Operations Officer (COO): The COO is next in line after the CEO, and is typically responsible for managing the day-to-day operations. This includes matters related to sales, marketing, production, human resources, etc. The COO usually reports directly to the CEO.

- Chief Financial Officer (CFO): The CFO is responsible for the financial matters and performance of the corporation. The CFO’s duties include reviewing financial reports, preparing, and allocating company budgets, and monitoring and reporting on expenditures and overall profitability. The CFO also reports directly to the CEO.

Conclusion

There are multiple factors which come together to determine the overall success and profitability of corporations. However, without the foundation of a solid and well-organised corporate structure in place, most companies will not be able to succeed. Like the foundations of a well-built house, a good corporate structure is a basic necessity for the long-term success and stability of any business.

How Can Offshore Protection Help You?

____

Offshore Protection is a boutique consultancy that specailizes in offshore solutions creating bespoke global strategies using offshore companies, trusts, and second citizenships so you can internationalize and diversify your business and assets.

We help you every step of the way, from start to finish with a global team of dedicated consultants. Contact us to see how we can help you.